australiatimes.ru Overview

Overview

Buy Stocks Easy

You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free online) or through another broker (who may charge. The purchase process is simple and often entails identifying and opening an account with a reputable broker, as well as choosing the ideal stock option. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. How to buy stocks. You can buy or sell stocks by opening a brokerage account through a financial services firm. Your financial advisor can help you get started. Cash App Stocks makes buying stocks easy, whether you're new to the stock market or already have a portfolio. Invest as much or as little as you want. Our guide takes you through the 10 things you need to know about investing, including what and where to buy, and how much risk to take. Invest in stocks to help grow your wealth. J.P. Morgan Wealth Management makes trading stocks easy with $0 commission online trades. FootnoteOpens overlay. Before you can start purchasing stocks, you need to select a brokerage account to do it through. You can choose to go with a trading platform offered by a. Simple answer? Buy low, sell high. Take advantage of compound interest to grow your wealth. Understand your risk tolerance, goals, and involvement level. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free online) or through another broker (who may charge. The purchase process is simple and often entails identifying and opening an account with a reputable broker, as well as choosing the ideal stock option. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. How to buy stocks. You can buy or sell stocks by opening a brokerage account through a financial services firm. Your financial advisor can help you get started. Cash App Stocks makes buying stocks easy, whether you're new to the stock market or already have a portfolio. Invest as much or as little as you want. Our guide takes you through the 10 things you need to know about investing, including what and where to buy, and how much risk to take. Invest in stocks to help grow your wealth. J.P. Morgan Wealth Management makes trading stocks easy with $0 commission online trades. FootnoteOpens overlay. Before you can start purchasing stocks, you need to select a brokerage account to do it through. You can choose to go with a trading platform offered by a. Simple answer? Buy low, sell high. Take advantage of compound interest to grow your wealth. Understand your risk tolerance, goals, and involvement level.

Define Your Goals and Strategies · Want to buy and sell stocks online? · Research the companies you want to invest in · Obtain a Quote · Place the Trade · Things to. This guide will help new traders understand exactly what stocks are and how to pick the right ones. Also, discover what can impact the price of a stock. Step-by-step guide to buying a stock · 1. Open your brokerage account · 2. Dig into your stock · 3. Buy your stock. The best trading platforms for beginners have low fees, easy-to-use interfaces and attainable minimums. See our best brokerage accounts for beginners here. I would start with books from the dummy series. (no pun intended) Thats where I started and they make it simple to understand. Also buffet books. Trade stocks with E*TRADE from Morgan Stanley. Easy-to-use tools, free research, and personalized guidance mean you never have to face the markets on your own. Invest in stocks, options, and ETFs at your pace and commission-free. Stocks & funds offered through Robinhood Financial. Other fees may apply. See our Fee. Before you can start purchasing stocks, you need to select a brokerage account to do it through. You can choose to go with a trading platform offered by a. EasyEquities is South Africa's best low-cost investment platform. Learn more about investing using our online tools and research and invest in Rands and. A common mistake that beginners make is trading too often. Instead of trying to buy something and sell it quickly to make money, think about investing as a long. We guide you through the steps to buying stocks. Whether you're a novice investor or seeking to refine your strategy, this comprehensive guide is tailored for. Usually you need to open an account with a broker to buy and sell stocks online. Some publicly traded companies, however, do offer a direct stock purchase plan. The best way to invest in the stock market is to buy a low cost, total market index fund and basically hold onto it forever (or until you need it). To start investing in stocks, you would find a company that you like and think might grow in value and then purchase its stock through a brokerage account. $0 online listed equity commissions · Platforms and tools for any experience level · Premium research and education · Award-winning 24/7 support · Invest in and. buying the stock and what price you think it's worth. Watch lists make it easy, and you can set them up with just a few clicks. ×. ✓ Watched. Now Playing. 0. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Buy direct. Some companies offer direct stock purchase plans (DSPPs). Search online or call or write the company whose stock you wish to buy, to inquire whether. Figure out your goals – A clear understanding of why you want to invest in the first place will help you to set specific goals. · Identify your investor profile.

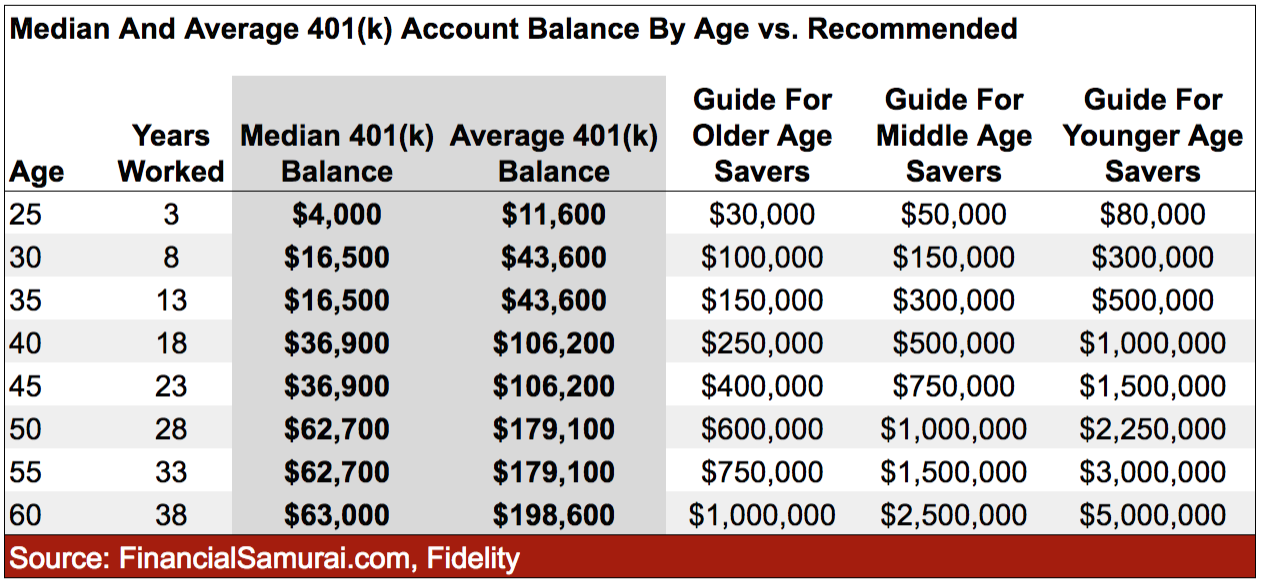

How Much Of Your Salary Can You Contribute To 401k

How Much More Can I Contribute to My (k) for Compared to ? For the tax year , the maximum amount that an employee can contribute to their If you're following Fidelity's benchmark as a guideline, your target is 10 times your salary at However, many variables can come into play when it comes to. Many experts recommend investing percent of your annual salary in a retirement savings vehicle like a (k). As an employee, there are limits to how much you can contribute to a (k) each year. The Internal Revenue Service (IRS) updates that information annually. In other words, if you're under 50, you can't put more than $22, total as employee contributions in your (k) accounts in , no matter how many accounts. Employees can invest more money into (k) plans in , with contribution limits increasing from $ in to $ in Financial experts generally recommend that everyone contribute 10% of their paycheck to a (k), but this may not be doable for all. Plus, often times we think. Aim to save at least 15% of your pre-tax income for retirement, taking advantage of the pre-tax contributions and potential employer matches offered by a (k). Total contributions to a participant's account, not counting catch-up contributions for those age 50 and over, cannot exceed $69,0($66, for ;. How Much More Can I Contribute to My (k) for Compared to ? For the tax year , the maximum amount that an employee can contribute to their If you're following Fidelity's benchmark as a guideline, your target is 10 times your salary at However, many variables can come into play when it comes to. Many experts recommend investing percent of your annual salary in a retirement savings vehicle like a (k). As an employee, there are limits to how much you can contribute to a (k) each year. The Internal Revenue Service (IRS) updates that information annually. In other words, if you're under 50, you can't put more than $22, total as employee contributions in your (k) accounts in , no matter how many accounts. Employees can invest more money into (k) plans in , with contribution limits increasing from $ in to $ in Financial experts generally recommend that everyone contribute 10% of their paycheck to a (k), but this may not be doable for all. Plus, often times we think. Aim to save at least 15% of your pre-tax income for retirement, taking advantage of the pre-tax contributions and potential employer matches offered by a (k). Total contributions to a participant's account, not counting catch-up contributions for those age 50 and over, cannot exceed $69,0($66, for ;.

Most common employer contribution is %. Just remember 1) income for k is capped at $k for (no clue what kind of doc you are), and 2) make sure to. However, it is ideal to contribute at least 10% to 15% of your salary, or more if possible. This can help ensure that you have enough savings. Many financial advisors suggest saving %* of your income over your career for a comfortable retirement. This can be easier if your company's (k) plan. Keep in mind that if you have a high salary, putting 10% or more of your salary into a (k) may not be feasible. The annual salary deferral contribution limit. That said, most financial advisors agree that 10% to 20% of your salary is a good amount to contribute toward your retirement fund—and at minimum, you should. Many experts recommend investing percent of your annual salary in a retirement savings vehicle like a (k). The IRS sets a (k) contribution limit every year. In , the (k) employee contribution limit is $, or $ if you are 50 or older. Second: You don't need to try and maximize your k contributions at this point. You should aim to ideally be saving % of your income. These contributions do not count against your elective deferral limit, but they do count against your maximum annual contribution limit. So if you're under These contributions do not count against your elective deferral limit, but they do count against your maximum annual contribution limit. So if you're under If you have an annual salary of $, and contribute 6%, your contribution will be $6, and your employer's 50% match will be $3, ($6, x 50%), for a. The annual maximum for is $18, If you are age 50 or over, a "catch-up" provision allows you to contribute additional $6, into your account. It is. Once you're contributing enough to get your employer match, consider saving even more. Fidelity suggests saving 15% of your pre-tax income for retirement, which. Along with income limits for opening a Roth, the IRS also sets limits on how much you can contribute to your Roth IRA each year. In , individual tax. Contribution limits for (k) plans ; , ; Employee pre-tax and Roth contributions · $22,, $23, ; Maximum annual contributions · $66,, $69, ; Age. Of course, there are limits as to how much you can contribute to your (k): In , you can put in up to $23, if younger than 50, and $30, if 50 or. In , the maximum you can contribute is $23, as the employee plus an additional 25% of compensation as the employer. People aged 50 and older can. (k) contribution limits For this calendar, the IRS allows (k) participants to set aside up to $23, per year. If you are older than 50, your plan may. Your proposed retirement savings: · Filing status and withholding: · Retirement plan information: · Contributing 5% instead of 1% reduces your paycheck by $ Simply fill out the information for yourself, including the k contribution limits of your employer – commonly a % match of your gross income. Keep in mind.

Stock Market Today Gamestop

With Gamestop stock trading at $ per share, the total value of Gamestop stock (market capitalization) is $B. Gamestop stock was originally listed at a. Largest shareholders include Vanguard Group Inc, BlackRock Inc., VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, IJH - iShares Core S&P Mid-Cap. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change The GameStop Corp. stock price is closed at $ with a total market cap valuation of $ B (M shares outstanding). The GameStop Corp. is trading on. GameStop Corp (GME) · Volume: 15,, · Bid/Ask: / · Day's Range: - Key Stock Data · P/E Ratio (TTM). (09/03/24) · EPS (TTM). $ · Market Cap. $ B · Shares Outstanding. M · Public Float. M · Yield. GME. The GameStop Corp stock price today is What Is the Stock Symbol for GameStop Corp? The stock ticker symbol for GameStop Corp is GME. Is GME the Same as $. In January , a short squeeze of the stock of the American video game retailer GameStop and other securities took place, causing major financial. Discover real-time GameStop Corporation Common Stock (GME) stock prices, quotes, historical data, news, and Insights for informed trading and investment. With Gamestop stock trading at $ per share, the total value of Gamestop stock (market capitalization) is $B. Gamestop stock was originally listed at a. Largest shareholders include Vanguard Group Inc, BlackRock Inc., VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, IJH - iShares Core S&P Mid-Cap. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change The GameStop Corp. stock price is closed at $ with a total market cap valuation of $ B (M shares outstanding). The GameStop Corp. is trading on. GameStop Corp (GME) · Volume: 15,, · Bid/Ask: / · Day's Range: - Key Stock Data · P/E Ratio (TTM). (09/03/24) · EPS (TTM). $ · Market Cap. $ B · Shares Outstanding. M · Public Float. M · Yield. GME. The GameStop Corp stock price today is What Is the Stock Symbol for GameStop Corp? The stock ticker symbol for GameStop Corp is GME. Is GME the Same as $. In January , a short squeeze of the stock of the American video game retailer GameStop and other securities took place, causing major financial. Discover real-time GameStop Corporation Common Stock (GME) stock prices, quotes, historical data, news, and Insights for informed trading and investment.

Dividend yield in %, ; P/E Ratio, ; Profit per share, ; Number of shares, m ; Market capitalization, bn. View the real-time GME price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Quote Overview ; 52 Wk Low: ; 52 Wk High: ; 20 Day Avg Vol: 5,, ; Market Cap: B ; Dividend: (%). As of September GameStop has a market cap of $ Billion. This makes GameStop the world's th most valuable company according to our data. The current price of GME is USD — it has decreased by −% in the past 24 hours. Watch GameStop stock price performance more closely on the chart. View GameStop Corp. Class A GME stock quote prices, financial information Latest GME news. TipRanks. Press releases. Today am ET GameStop call. GME Gamestop Corporation - Class A stock NYSE ; Market Cap. B ; Headquarters. Grapevine, Texas, USA ; Industry. Specialty Retail ; Next Earnings. . GameStop Corp. ($GME) Stock Forecast: Up % Today. Morpher AI identified a bullish signal. The stock price may continue to rise based on the momentum. Intraday Data provided by FACTSET and subject to terms of use. Historical and current end-of-day data provided by FACTSET. All quotes are in local exchange time. Apr, Downgrade, Ascendiant Capital Markets, Hold → Sell, $12 → $10 ; Mar, Reiterated, Telsey Advisory Group, Underperform, $33 → $ On Monday 09/02/ the closing price of the GameStop Corp share was $ on BTT. Compared to the opening price on Monday 09/02/ on BTT of $, this. GameStop Corp. Cl A ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Over the last year, GameStop shares have traded in a share price range of $ to $ GameStop currently has ,, shares outstanding. The market. GameStop (GME) Stock Moves %: What You Should Know. The latest trading day saw GameStop (GME) settling at $, representing a % change from its. News ; OPEN. ; PREV. CLOSE. ; VOLUME. 15,, ; MARKET CAP. B ; DAY RANGE · GME Related stocks ; GME, , %. Gamestop Corp ; EA, , +%. Electronic Arts Inc ; FLUT, , +%. Flutter Entertainment Plc. GameStop · Open. · Previous Close. · High. · Low. · 52 Week High. · 52 Week Low. · Beta. · TTM EPS Trend. (+% YoY). The live GameStop price today is $ USD with a hour trading volume of $ USD stock market. If the project did not submit this data nor was. See GME stock price and Buy/Sell GameStop. Discuss news and analysts' price predictions with the investor community. GameStop offers new and pre-owned gaming platforms from the major console and PC manufacturers, sells new and pre-owned gaming software for current and certain.

First Home Saver

The First Home Super Saver Scheme (FHSSS) allows first home buyers to make extra voluntary superannuation contributions to save on tax and build a deposit. First Home Super Saver Scheme Example. Say you are earning $60, You want to put $10, of that salary (pre-tax) towards your home deposit. If you pay tax. The First Home Super Saver Scheme is a valuable initiative to help first-time buyers overcome the challenges of entering the property market. These contributions, along with deemed earnings, can be withdrawn for a home deposit. For most people, the FHSSS could boost the savings of a first home buyer. Save for your first home, tax-free. Pay no taxes on your withdrawals when you use your FHSA towards the purchase of a qualifying home. Under the FHSS scheme, you have 12 months to sign a contract to buy or build a home after you withdraw your first home super savings. So, when you're ready. This regular savings account has been designed specifically for members or their families looking to support them, to save for their first home. How to apply. If you're interested in purchasing your first home with the help of the FHSS Scheme, you'll first need to make the voluntary contributions into an eligible. The First Home Super Saver (FHSS) scheme is a way of using super for a house deposit, if you're buying your first home and you've added extra money to your. The First Home Super Saver Scheme (FHSSS) allows first home buyers to make extra voluntary superannuation contributions to save on tax and build a deposit. First Home Super Saver Scheme Example. Say you are earning $60, You want to put $10, of that salary (pre-tax) towards your home deposit. If you pay tax. The First Home Super Saver Scheme is a valuable initiative to help first-time buyers overcome the challenges of entering the property market. These contributions, along with deemed earnings, can be withdrawn for a home deposit. For most people, the FHSSS could boost the savings of a first home buyer. Save for your first home, tax-free. Pay no taxes on your withdrawals when you use your FHSA towards the purchase of a qualifying home. Under the FHSS scheme, you have 12 months to sign a contract to buy or build a home after you withdraw your first home super savings. So, when you're ready. This regular savings account has been designed specifically for members or their families looking to support them, to save for their first home. How to apply. If you're interested in purchasing your first home with the help of the FHSS Scheme, you'll first need to make the voluntary contributions into an eligible. The First Home Super Saver (FHSS) scheme is a way of using super for a house deposit, if you're buying your first home and you've added extra money to your.

Under the FHSS scheme, you have 12 months to sign a contract to buy or build a home after you withdraw your first home super savings. So, when you're ready. Behind on home loan payments or related expenses? Texas Homeowner Assistance is here to help. Texas Homeowner Assistance provides financial assistance to. Use it to save up to $40, for your first home · Contribute tax-free for up to 15 years · Unused contribution room can be carried over to the next year, up to a. The FHSA is a registered plan that combines some of the features of an RRSP and a TFSA to help save towards your first home! Your voluntary super contributions can be used to help purchase your first home through the First Home Buyer Super Saver Scheme. Learn more about the FHSSS. The First Home Savings Account (FHSA) is a registered investment account that can help Canadians contribute up to $40, for their first home. Any growth from. First Home Super Saver (FHSS or FHSSS) is a scheme that helps Victorians save more for their first home deposit in their super accounts, where it's generally. The FHSS Scheme allows first home buyers to make contributions to their super, then withdraw those contributions for a deposit to buy or build a home to. The FHSSS is designed to assist first home buyers to save a deposit in the tax effective environment of their super fund. It allows individuals to make. Details of the FHSS Scheme. In a nutshell, the scheme allows first-home buyers to make voluntary contributions of up to $15, p.a. to their super. By applying. The First Home Super Saver (FHSS) Scheme allows first home buyers to make contributions to their super, then withdraw those contributions for a deposit to buy. To be eligible for the FHSS, you must be at least 18 years old, have never owned property in Australia, and have not previously accessed FHSS funds for home. If you're planning on buying your first home, you could use super to help save for a deposit through the first home super saver scheme. Learn more. The First Home Super Saver (FHSS) scheme enables you to use voluntary contributions from your superannuation to put towards your deposit, helping you to buy. Saving faster with the First Home Super Saver scheme Now owning your first home could become a reality sooner than you think. The Government's First Home. The FHSS lets you save for a first home deposit using money added to your super account, as well as (or instead of) your bank account savings. The FHSS scheme allows you to save for your first home deposit within your superannuation account. The scheme may be an opportunity for some to save on tax —. The First Home Super Saver Scheme makes it easier for you to save your deposit by making before-tax contributions to your superannuation. Using the FHSSS, you. With the First Home Super Saver (FHSS) scheme, you can add up to $ of extra savings to your super, then take it out to buy your first home. The First Home Super Saver Scheme allows you to save for your first home within your super, in a tax-effective way. Superannuation · Buying property with super.

Td Banking Info

Select the account you want direct deposit information for; Select the Manage tab; Select the "Direct deposit form (PDF)"; You will then get a pop-up page (PDF). The Toronto-Dominion Bank engages in providing financial products and services. It operates through the following segments: Canadian Retail, U.S. Retail. Welcome to TD Bank! Explore our banking services, credit cards, loans, home lending, and other financial products for you and your business. Common. At least the bank allowed it. Some don't. Furthermore, some banks will seek more information even if it's not cash, such as check. It's. banks, and get the details on upcoming conferences and events. Find More FDIC News · Press Releases · Financial Institution Letters · Conferences & Events. TD Bank offers retail bank services to individuals and businesses, including checking, savings, credit cards, mortgages and loans. Clients can review their. Log into the TD app. · From the home screen, select Accounts. · Select the account you want to use for the direct deposit. · Select the Summary tab. 1. Log in to EasyWeb 2. Click on the account for which you require Direct Deposit information. 3. Once on the Account Activity page, look to the far right of. • Access account settings and change personal information • Access TD for Me, TD Bank personalized, to get info on accounts, events, tips and special offers. Select the account you want direct deposit information for; Select the Manage tab; Select the "Direct deposit form (PDF)"; You will then get a pop-up page (PDF). The Toronto-Dominion Bank engages in providing financial products and services. It operates through the following segments: Canadian Retail, U.S. Retail. Welcome to TD Bank! Explore our banking services, credit cards, loans, home lending, and other financial products for you and your business. Common. At least the bank allowed it. Some don't. Furthermore, some banks will seek more information even if it's not cash, such as check. It's. banks, and get the details on upcoming conferences and events. Find More FDIC News · Press Releases · Financial Institution Letters · Conferences & Events. TD Bank offers retail bank services to individuals and businesses, including checking, savings, credit cards, mortgages and loans. Clients can review their. Log into the TD app. · From the home screen, select Accounts. · Select the account you want to use for the direct deposit. · Select the Summary tab. 1. Log in to EasyWeb 2. Click on the account for which you require Direct Deposit information. 3. Once on the Account Activity page, look to the far right of. • Access account settings and change personal information • Access TD for Me, TD Bank personalized, to get info on accounts, events, tips and special offers.

TD engaged in investment banking, capital markets and wholesale banking activities. information about your device and usage of our apps and websites. Find your TD Bank routing number. Check this page to find out all about TD Bank bank routing numbers and how they are used. Locate the TD Ameritrade, Inc. account number. You can request it from the The Charles Schwab Corporation provides a full range of brokerage, banking and. Payment, direct deposit may be the fastest and safest way to go. Make sure you double-check that the IRS has your current banking info. You. Bank whenever and wherever you want with online banking, mobile banking, Bank by Phone and 24/7 Customer Service. Plus, access your accounts at thousands of. The bank allegedly shared faulty information tied to credit card and bank deposit accounts with the credit reporting agencies even though it “knew or suspected”. Field Name. To Canadian Bank ; Sender Information. Mandatory Field. TD Bank will automatically populate the sender's name and address based on the settlement. The account number - seven to twelve digits - identifies your individual account. Bank routing numbers are used to process cheque and electronic transactions. Get info on how to manage your TD Bank accounts with our online and mobile services, plus tips and tools designed to make your day-to-day banking easier. TD Bank (United States) ; Trade name. TD Bank ; Number of locations. 1, ; Area served. Connecticut, Delaware, Florida, Maine, Maryland, Massachusetts, New. Access account settings and change personal information. • Access TD for Me, TD Bank personalized, to get info on accounts, events, tips and special offers. Institution Number: The institution number for all TD Canada Trust accounts is Privacy Policy | Legal | Accessibility. TD Bank's posts Please see below for the information on impacts to our services experienced today. Since Friday's global technology disruption, TD services. Institution Details ; Main Office Address · Wilmington, DE ; Primary Website. australiatimes.ru ; Locations · 1 in foreign location. ; Consumer. The TD app (Canada) for Android provides quick, easy, secure access to your TD Canada Trust chequing, savings, credit, and investment accounts. TD Bank serves more than million customers in the United States with a network of over 1, branches in 16 states and the District of Columbia. Field Name. To Canadian Bank ; Sender Information. Mandatory Field. TD Bank will automatically populate the sender's name and address based on the settlement. To redeem and schedule your tour, please visit The Sports Museum's Information Kiosk located outside of the ProShop powered by '47 in North Station and present. TD Bank USA, N. A. (). Institution Information. City, State: Wilmington, DE. Charter / License: Institution Information ; TD Bank USA, N. A., New York, NY, , Inactive, 01/16/ ; TD Bank USA, National Association, Wilmington, DE, , Active, 09/18/.

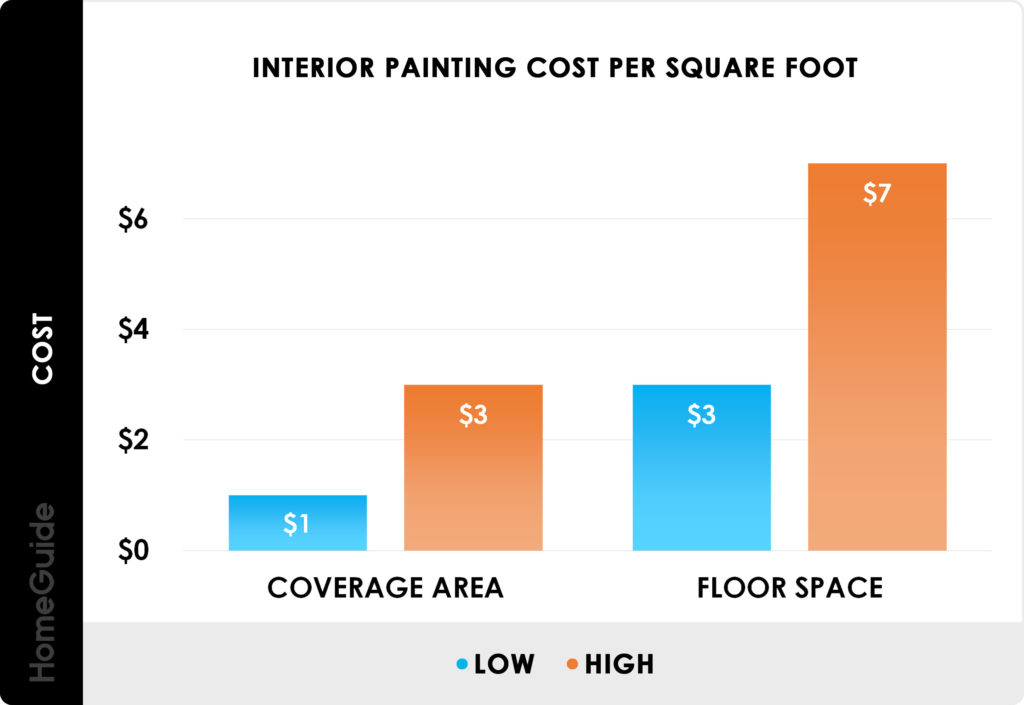

How Much Do Interior House Painters Charge Per Hour

Labor cost is an essential part of your overall interior house painting project. Most companies have an hourly rate between $40 and $95 per hour for interior. Revamp your kitchen cabinets with a professional paint job by our Interior Painters for an inspired new look. How much do Local Pro painters charge for. The average cost to hire a professional painter ranges from $40 to $60 per hour, with the average homeowner paying around $50 an hour for a journeyman painter. As per HomeGuide, the average cost to paint a house (interior) in Canada painting or hiring professional painters would be more cost-effective. DIY. You should expect to pay between $20 and $50 per hour for professional painting services depending on your location and the type of paint used. On average, however, homeowners can expect to pay about $ per hour for a standard house painting job. Simpler jobs may cost less–around $/hour–whereas. The cost of a painter varies depending on their experience and the type of job. For a standard room, the average hourly rate is $60 to $ Generally, most painters charge per square foot or per hour, and the cost can range from a few hundred to several thousand dollars. If you need. On average, you should budget $ to $3 per square foot for painting walls, including materials and labor. Painters will charge more for accent walls or. Labor cost is an essential part of your overall interior house painting project. Most companies have an hourly rate between $40 and $95 per hour for interior. Revamp your kitchen cabinets with a professional paint job by our Interior Painters for an inspired new look. How much do Local Pro painters charge for. The average cost to hire a professional painter ranges from $40 to $60 per hour, with the average homeowner paying around $50 an hour for a journeyman painter. As per HomeGuide, the average cost to paint a house (interior) in Canada painting or hiring professional painters would be more cost-effective. DIY. You should expect to pay between $20 and $50 per hour for professional painting services depending on your location and the type of paint used. On average, however, homeowners can expect to pay about $ per hour for a standard house painting job. Simpler jobs may cost less–around $/hour–whereas. The cost of a painter varies depending on their experience and the type of job. For a standard room, the average hourly rate is $60 to $ Generally, most painters charge per square foot or per hour, and the cost can range from a few hundred to several thousand dollars. If you need. On average, you should budget $ to $3 per square foot for painting walls, including materials and labor. Painters will charge more for accent walls or.

Painters here start at $ decent painters make Great painters and crew leads make

The average cost to paint a commercial building · - The going rate for labor is between $55 and $65 per hour · - How many hours will it take to complete my. Painter salaries typically range between $30, and $59, yearly. The average hourly rate for painters is $ per hour. Painter salary is impacted by. Cost of interior house painting per room ; Average cost per room, $ – $ ; Cost per square meter, $10 – $60 ; Cost per hour, $65 – $95 ; Cost per day, $ –. When you include the cost of walls, trim, and ceilings in the painting project, the cost per square foot rises to $ The cost of interior home painting can. Painters charge anywhere from $$40 per hour, depending on how easy or complicated the project at hand is. Painters with less experience tend to charge less. Hourly rates for professional painters can cost you between $20 and $50 for a basic paint job, or $ or more per hour for more specialized work like painting. Some contractors use a rough base rate of $ or $ per square foot, some multiply 4 to 6 times the paint cost, some estimate the time the job will take. The hourly rates for individual or solo painters can vary, often falling within the range of $25 to $30 per hour, depending on their experience level. According. painter to paint the interior or exterior of your home. Irrespective of the Today, many are opting to change it for a smoother and plain ceiling look. To complete an interior painting job it may cost you $3, on average, excluding the cost of the paint. Examples of interior painting jobs include all walls. To start, let's talk about hourly rates. Painters typically charge between $25 and $ per hour, according to HomeAdvisor. So if your painter is charging $ Others may charge by the hour, particularly if they are doing small jobs. A fair hourly rate for a painter is somewhere between $40 and $80 per hour. The. Interior painting cost per hour and exterior painter cost per hour are usually the same, ranging from $25 to $ per hour and per painter. Therefore, two. Cost of Interior House Painting or Staining in North Carolina $ per hour (Range: $ - $) $ per square foot (Range: $ - $). How much do murals and trompe l'oeil cost? Specialty painting, like murals and trompe l'oeil, costs $40 to $50 per hour. Paint might range between $75 to $ How much do Painters charge to paint a house interior? There are as many Why do Painters Price by the Square Footage of the Floor? You may have. (Includes Paint) ; Small Room 10×12 ; Small Room 10× Sq Ft, Wall Surface, $ to $ ; Small Room 10×12 · 44 Linear Ft, Baseboard, $87 to $ Contractors that specialize in office painting charge anywhere from $50 to $65 per hour. If we assume an hourly rate of $60 per hour, the labour cost for the. How Much Does Professional Painting Cost? · Painting Cost per Hour. Currently, the average cost to hire a professional painter is $20 to $50 per hour. · Painting. Painters in Alberta typically charge between $21 and $30 per hour. The average hourly wage for painters in Alberta is $ This price, however, can vary.

Which Type Of Mortgage Loan Is Best

Understanding Common Types of Mortgage Loans · Fixed-Rate Mortgage: This mortgage type has an interest rate that stays the same for the life of the loan. When looking for a good deal on a home loan (mortgage), the interest rate matters. A home loan is a long-term debt, so even a small difference in interest. From conventional loans to government-backed FHA, VA and USDA loans, learn about the different types of mortgage loans so you can choose the right one. Table loan · Table loans provide the discipline of regular payments and a set date when they will be paid off. · They offer the certainty of knowing what your. Fixed-rate loans can be a good choice for people who plan to live in their homes for a long time, especially if they are able to lock in a low interest rate. Home loans are available from several types of lenders—thrift institutions*, commercial banks, mortgage compa- nies, and credit unions. Different lenders may. Which Home Loan is Right for You? · Fixed Rate Mortgages · Adjustable Rate Mortgages (ARM) · Jumbo Loans · FHA Loans · USDA Loans · VA Loans · Doctor/Physician Loans. View rates, learn about mortgage types and use mortgage calculators to help find the loan right for you Top home mortgage FAQs. How does my credit. These loans are best for borrowers with good credit and an adequate down payment, which could be as little as 3% of the purchase price. Conventional loans can. Understanding Common Types of Mortgage Loans · Fixed-Rate Mortgage: This mortgage type has an interest rate that stays the same for the life of the loan. When looking for a good deal on a home loan (mortgage), the interest rate matters. A home loan is a long-term debt, so even a small difference in interest. From conventional loans to government-backed FHA, VA and USDA loans, learn about the different types of mortgage loans so you can choose the right one. Table loan · Table loans provide the discipline of regular payments and a set date when they will be paid off. · They offer the certainty of knowing what your. Fixed-rate loans can be a good choice for people who plan to live in their homes for a long time, especially if they are able to lock in a low interest rate. Home loans are available from several types of lenders—thrift institutions*, commercial banks, mortgage compa- nies, and credit unions. Different lenders may. Which Home Loan is Right for You? · Fixed Rate Mortgages · Adjustable Rate Mortgages (ARM) · Jumbo Loans · FHA Loans · USDA Loans · VA Loans · Doctor/Physician Loans. View rates, learn about mortgage types and use mortgage calculators to help find the loan right for you Top home mortgage FAQs. How does my credit. These loans are best for borrowers with good credit and an adequate down payment, which could be as little as 3% of the purchase price. Conventional loans can.

Adjustable Rate Versus Fixed Rate Mortgages Fixed-rate loans look like a good bet these days and the spread compared with adjustable rate loans has dropped. Your Loan Officer will explain your options and deliver a mortgage with the best loan terms available. There are a number of conventional loan types offered. These loans are best for borrowers with good credit and an adequate down payment, which could be as little as 3% of the purchase price. Conventional loans can. Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low origination fees. · Veterans United. FHA loans offer a path to homeownership for borrowers with a less-established credit history and little savings for a down payment. These mortgages have more. Most borrowers choose fixed-rate mortgages. Your monthly payments are more likely to be stable with a fixed-rate loan, so you might prefer this option if you. Credit score: The higher your credit score, the lower the rate. · Credit history: · Type of employment and income: · Loan size: · Loan-to-value ratio (LTV): · Loan. Types of Home Loans · Low Down Payment Loans · Conventional And Conforming Loans · FHA Loans · VA Loans · USDA Loans · Jumbo & Non-Conforming Loans · Fixed-Rate &. How to Choose the Best Mortgage Home Loan for You · WHAT YOU WILL LEARN: · What is a Mortgage Home Loan? · Fixed-Rate Mortgage Loans · Adjustable-Rate Mortgage. Fixed-rate loans are great for buyers who don't want to have to worry about their monthly principal and interest payments changing down the road. Buyers who are. Custom terms typically range from 10 to 40 years, depending on the borrower's preferences and the lender's willingness to accommodate them. Best for: Homebuyers. Those with a steady income, who don't have other significant debts are the best candidates for a year, fixed-rate loan. Since the loan amount is shorter, the. Nonfixed-rate mortgages are a possible option for borrowers who are comfortable with their ability to handle payment increases. They can also be a good option. Guaranteed Rate · Pennymac · Bank of America · Alliant Credit Union · Wells Fargo · Veterans United Home Loans · BMO Bank · PNC Bank. Still have questions about which loan type is best for you? Ask an agent. · 30 Year Fixed Rate Mortgage. A 30 Year fixed rate mortgage ensures that your interest. The year fixed-rate mortgage is the best type of mortgage and the only one we at Ramsey ever recommend to home buyers because it has the lowest total cost. 1. Conventional Mortgages · Good credit · A down payment of at least 3% · A manageable debt-to-income ratio · Private mortgage insurance (PMI) for loans with a down. - If you want to switch to a different type of mortgage with the same lender The good news is that with BMO U.S., you can apply for a mortgage. Meet with several lenders. You don't have to go with the first lender quote you receive. You can shop around to find the best loan to fit your needs—research. While a year fixed-rate mortgage is a popular conventional loan, you have other options, such as a year fixed-rate loan or a 7/6 ARM Footnote(Opens.

Best Credit Card For Occasional Use

Chase Sapphire Preferred is our top choice because of its amazing signup bonus, reasonable annual fee, and the amazing value of the points it earns. If you're. If you travel frequently and use the card for everyday items—like restaurants, gas, groceries, the occasional latte—a general travel rewards card may earn you. 1. Chase Freedom Unlimited® · 2. Capital One Quicksilver Cash Rewards Credit Card · 3. Citi Double Cash® Card · 4. Discover it® Cash Back · 6. Discover it® Chrome. Thinking about getting a credit card but not sure which one to go for? Find out Martin Lewis' top picks at MoneySavingExpert. Intro Offer: Bonus, 0% purchase APR, 0% balance transfer APR. Rewards: Four-part cash back rewards plan. Learn More. BEST FOR ROAD TRAVEL. Discover it. Like everything good, though, credit card usage is best in moderation. Not Whether it's the occasional shopping trip, your monthly phone or utility. The best way to maximize your credit card is to use a card that aligns with your spending patterns and always pay your balance off in full so you don't incur. The SKYPASS Visa card is the only Visa credit card that allows you to earn up to 1 SKYPASS mile for every $1 in net purchases and double miles on Korean Air. Many credit cards offer perks for occasional and frequent travelers. When searching for the best travel credit card, look for these features and. Chase Sapphire Preferred is our top choice because of its amazing signup bonus, reasonable annual fee, and the amazing value of the points it earns. If you're. If you travel frequently and use the card for everyday items—like restaurants, gas, groceries, the occasional latte—a general travel rewards card may earn you. 1. Chase Freedom Unlimited® · 2. Capital One Quicksilver Cash Rewards Credit Card · 3. Citi Double Cash® Card · 4. Discover it® Cash Back · 6. Discover it® Chrome. Thinking about getting a credit card but not sure which one to go for? Find out Martin Lewis' top picks at MoneySavingExpert. Intro Offer: Bonus, 0% purchase APR, 0% balance transfer APR. Rewards: Four-part cash back rewards plan. Learn More. BEST FOR ROAD TRAVEL. Discover it. Like everything good, though, credit card usage is best in moderation. Not Whether it's the occasional shopping trip, your monthly phone or utility. The best way to maximize your credit card is to use a card that aligns with your spending patterns and always pay your balance off in full so you don't incur. The SKYPASS Visa card is the only Visa credit card that allows you to earn up to 1 SKYPASS mile for every $1 in net purchases and double miles on Korean Air. Many credit cards offer perks for occasional and frequent travelers. When searching for the best travel credit card, look for these features and.

The Chase Freedom Unlimited® (review) is another good option for a no-annual fee cash rewards credit cards. Earn 5% cash back on travel purchased through Chase. The Chase Sapphire Preferred® is a great starter card that earns Premium Ultimate Rewards that can be transferred into over a dozen partners many of which are. Best for fair credit: Capital One QuicksilverOne Cash Rewards Credit Card Here's why: This flat-rate cash back card designed for people with fair credit makes. Take Flight With Extra Bonus Points for Your Next Trip · This card is best for · Rates, Fees & Rewards. Chase Freedom Unlimited®: Best feature: Flexible cash back rewards. United Gateway℠ Card: Best feature: United Airlines travel rewards. Gas rewards credit cards typically offer points, cash back, or other forms of rewards when you use them for fuel purchases. They typically offer these rewards. The Chase Sapphire Reserve® is the best travel credit card of because of its luxury perks, valuable credits and lucrative rewards program. Widely accepted – in Australia, most credit cards are issued by Visa, Mastercard or American Express. That means you can use your travel credit card wherever. Many leading airlines offer exceptional services to various Asian destinations, and savvy travelers can use points from credit cards like Amex, Chase, Capital. A good travel credit card (or a few) is a tool that all financially responsible travelers should be using. However, knowing which travel credit card(s) to apply. However, the Ink Business Preferred offers 25% more value if you use your points to book travel through the Chase Travel portal. Learn more about the card in. If you're an occasional flyer who's looking to earn miles on everyday purchases, the United Gateway℠ Card could be a good fit for your lifestyle. The card. Find the best credit card by American Express for your needs. Choose between travel, cash back, rewards and more. Apply for a credit card online. That's because specialist travel credit card providers typically don't charge you fees to use your card abroad. When you use a debit card or a regular credit. Find the best credit card by American Express for your needs. Choose between travel, cash back, rewards and more. Apply for a credit card online. With the right travel credit card, you can avoid hefty foreign spending fees, and there are other pros of using a credit card instead of cash abroad, too. using a travel credit card is a great way to earn rewards. What are travel credit cards? Travel cards work like many credit cards; they earn rewards in. Why We Like It: The Chase Sapphire Preferred® Card is the best credit card for international travel overall because of its great rewards, low fees and helpful. If you're an occasional flyer who's looking to earn miles on everyday purchases, the United Gateway℠ Card could be a good fit for your lifestyle. The card.

Carpet Cleaning Business

Magic Wand Company provides full financing and leasing of your carpet cleaning equipment for those looking to start a carpet cleaning business and support for. Chem-Dry carpet cleaning services deliver a deeper, longer-lasting clean to your carpets. Find a location today for carpet cleaners near you! We'll cover the foundational steps you need to begin if you've thought of starting a professional carpet cleaning company. Are you looking for some catchy and creative slogan ideas for your carpet cleaning business? Look no further! In this article, we will provide you with a. Handling carpet cleaning leads properly is important. Partners in carpet cleaning businesses need to answer our phone leads quickly, ask qualifying questions to. Professional Carpet Cleaning Service in Edmonton for Offices, Restaurants, Buildings, Churches and More! They include enough chemicals to handle several jobs and a variety of accessories for cleaning different types of carpeted surfaces. Plus, we. As far as expenses of running a business, carpet cleaning has one of the lowest cost of operations while having the highest profit margins. There are a few. This article will highlight what to expect when starting your carpet cleaning business and offer insight that you might not have considered for your new. Magic Wand Company provides full financing and leasing of your carpet cleaning equipment for those looking to start a carpet cleaning business and support for. Chem-Dry carpet cleaning services deliver a deeper, longer-lasting clean to your carpets. Find a location today for carpet cleaners near you! We'll cover the foundational steps you need to begin if you've thought of starting a professional carpet cleaning company. Are you looking for some catchy and creative slogan ideas for your carpet cleaning business? Look no further! In this article, we will provide you with a. Handling carpet cleaning leads properly is important. Partners in carpet cleaning businesses need to answer our phone leads quickly, ask qualifying questions to. Professional Carpet Cleaning Service in Edmonton for Offices, Restaurants, Buildings, Churches and More! They include enough chemicals to handle several jobs and a variety of accessories for cleaning different types of carpeted surfaces. Plus, we. As far as expenses of running a business, carpet cleaning has one of the lowest cost of operations while having the highest profit margins. There are a few. This article will highlight what to expect when starting your carpet cleaning business and offer insight that you might not have considered for your new.

What is ProStar's Business & Office Carpet Cleaning process? · Pre-treatment of stains · Pre-treatment of high traffic areas · Hot water extraction (steam cleaning). Under our Business Carpet Cleaning program, we also offer Janitorial Services. · Flood Restoration. Water damage cleanup & repair. Please. The carpet cleaning industry has grown and will continue to experience growth through at least IBISWorld estimates that industry-wide, the revenue will. Professional carpet cleaners can also turn to Jon-Don for business-building advice and tools. From marketing and sales information to tips on providing value-. Servgrow is simple-to-use carpet cleaning business software that manages your entire business and back-and-forth with customers. If you're the owner of a professional cleaning business that specializes in carpet cleaning, you should consider protecting it with a carpet cleaning. As a carpet cleaning professional or an aspiring cleaning business owner, you understand the importance of appearance. Not only when it comes to rugs. Carpet Cleaning, Cleaning Services, Carpet and Rug Cleaners BBB business or ongoing review/update of the business's file. Didn't find the. Crystal Clean Services is a professional upholstery and carpet cleaner that built the business on the referrals of customers. When it comes to business carpet cleaning, ServiceMaster Clean is your go-to solution. With our carpet cleaning services nearby, we specialize in providing top-. Take into account business license and permit fees, business registration fees, insurance, cleaning supplies and any required equipment. Once you have properly trained carpet techs on your team, new markets will open up for you. A majority of cleaning contractors do not have qualified technicians. Commercial carpet cleaning services. We offer a variety of professional cleaning services for our commercial & business accounts. We clean offices, retail. Given that commercial carpet cleaning is said to be one of the daunting tasks at the workspace, and if you need to clean your carpet frequently for the reason. Carpet cleaning service demand is primarily correlated with changes in per capita disposable income, consumer spending, business profit and the number of US. We are a locally owned carpet cleaning business in Calgary and that means you work with a company that is accountable for the work completed. Regardless of the size or type of your business, we can help prolong the life of your carpet and keep it looking new longer. Our commercial carpet cleaning. Make your business stand out from the crowd with Carpet Cleaning business cards from Zazzle Canada. Choose from an array of business-orientated designs or. We Have Your Back In All Situations · Citrus-O The Natural Choice for Carpet Cleaning · Clean Scene Investigators · From Real Customers · No Business Too Big or Too.

Us Citizen To Canada

International transportation companies such as airlines may require travellers to present a passport before boarding. Canadian citizens may face delays or may. Travellers must apply the eTA and receive approval prior to boarding their flight to Canada. Exceptions include US citizens and travellers with a valid visa. U.S. citizens and permanent residents entering Canada by land are required to possess the requisite documentation, such as a passport, driver's license. Citizenship services. Steps to become a Canadian citizen. Get proof of citizenship. ; Notarial services. Have your documents certified and authenticated. Can an American Citizen Work in Canada? · Proof that you're allowed to work in Canada: You'll need a PR card, CoPR, work permit, or study permit to legally work. citizenship when entering the U.S.. U.S. citizens visiting Canada will be required to present one of the travel documents listed here: U.S. Passport; U.S. Canadian visitors can usually stay in the United States for 6 months without a visa. You must declare your intended duration of stay upon entry into the United. US citizens can obtain Canadian citizenship, but just as other foreign nationals, they need to become Permanent Residents first. After having held Permanent. One of the easiest ways to immigrate to Canada from the US is through Canada's Express Entry system. Express Entry is used to process the majority of Canadian. International transportation companies such as airlines may require travellers to present a passport before boarding. Canadian citizens may face delays or may. Travellers must apply the eTA and receive approval prior to boarding their flight to Canada. Exceptions include US citizens and travellers with a valid visa. U.S. citizens and permanent residents entering Canada by land are required to possess the requisite documentation, such as a passport, driver's license. Citizenship services. Steps to become a Canadian citizen. Get proof of citizenship. ; Notarial services. Have your documents certified and authenticated. Can an American Citizen Work in Canada? · Proof that you're allowed to work in Canada: You'll need a PR card, CoPR, work permit, or study permit to legally work. citizenship when entering the U.S.. U.S. citizens visiting Canada will be required to present one of the travel documents listed here: U.S. Passport; U.S. Canadian visitors can usually stay in the United States for 6 months without a visa. You must declare your intended duration of stay upon entry into the United. US citizens can obtain Canadian citizenship, but just as other foreign nationals, they need to become Permanent Residents first. After having held Permanent. One of the easiest ways to immigrate to Canada from the US is through Canada's Express Entry system. Express Entry is used to process the majority of Canadian.

Canadian citizens do not need a U.S. Visa. All Canadian citizen F-1 and J-1 students arriving by air or at a land border will receive an electronic I You. Tax Traps Every US Citizen Living in Canada Should Know · Do not invest in TFSAs; these are an excellent way for Canadians to save money as the CRA doesn't tax. Q: Can I use my REAL ID card to cross the border into Canada and Mexico and for international travel? Q: Are other categories of non-U.S. citizens that are. Lawful permanent residents of the U.S. need an eTA to fly to or transit through a Canadian airport. They must present a valid Green Card and a valid passport at. Canadians typically do not require visas to enter the United States, although there are some exceptions. Citizens of certain other countries also do not require. Canadians can apply to naturalize as U.S. citizen after they have been green card holders for either three years or five years. As a Canadian citizen you can visit and stay in the United States for up to 6 months without a visa. It is important to note that when entering the United. If you are a citizen of the United States over the age of 16, you will need a Passport, a Passport Card or Enhanced Driver's Licence (only issued by certain. If you are a Canadian citizen, you do not need a visa to enter the United States. However, Mexican citizens must obtain a U.S. visa. Entering Canada or Mexico. Over one million US citizens live in Canada. Canada's peaceful, liberal culture, coupled with the country's close physical proximity to the US. Citizens of Canada traveling to the United States do not require a nonimmigrant visa, except for the travel purposes described below. Canadian citizens who are. Documents Required to Cross the US-Canadian Border ; US Citizens 16 and Over · United States Passport, or · Amish and Mennonite Old Order only: copy of birth. Canadian and U.S. citizens must present either a valid passport or a valid Nexus cardOpens in New Windowwhen travelling by air between Canada and the United. Official U.S. Department of State American Citizen Services Information for Canada - Official U.S. Department of State American Citizen Services Information. Official U.S. Department of State American Citizen Services Information for Canada - Official U.S. Department of State American Citizen Services Information. The U.S. Visitors Travel Information Guide prepared by the Canadian Tourism Commission states that United States citizens and permanent residents entering. US Citizens and US Permanent Residents who are currently in Canada may apply for their study permit by travelling to a US/Canada land border (“flapoling”). Yes. A Passport (or a Passport Card or Enhanced Driver's License if coming by land) is required for crossing the border into Canada unless you are age 15 or. Citizenship services. Steps to become a Canadian citizen. Get proof of citizenship. ; Notarial services. Have your documents certified and authenticated. To enter Canada, your passport must be valid for the length of your planned stay. If you're travelling through another country on your way to or from Canada.

2 3 4 5 6 7