australiatimes.ru Tools

Tools

Can You Sell Equity In Your House

Instead, they can tap into their equity through a home equity loan, a home equity line of credit (HELOC), or a cash-out refinance. Key Takeaways. Home equity is. You could also use your equity to jump into real estate investing. Let's say you're interested in getting an investment property loan to buy a rental property. If you have built enough equity in your home, you may be able to sell it for a profit. If you own your home and are over 55, an equity release scheme could allow you to release some of the value of your home. And you've heard about home equity loans. But are they right for you? Is there a better way to buy? Here are two options for using your equity in your current. There is usually a lot of flexibility in how you use a home equity loan. Keep in mind: If you are thinking of selling your home in the near future, the home. Funds from a home equity loan, HELOC, or cash-out refinance gives you the opportunity to invest in other properties, the stock market, start a business, or fund. If you're not in a financial position to take on more debt in general, you may not be ready for a second home. If you plan to eventually sell your current home. There's another option to use your home equity, and it's the subject of this article: you can provide a gift of equity to a close family member if you sell your. Instead, they can tap into their equity through a home equity loan, a home equity line of credit (HELOC), or a cash-out refinance. Key Takeaways. Home equity is. You could also use your equity to jump into real estate investing. Let's say you're interested in getting an investment property loan to buy a rental property. If you have built enough equity in your home, you may be able to sell it for a profit. If you own your home and are over 55, an equity release scheme could allow you to release some of the value of your home. And you've heard about home equity loans. But are they right for you? Is there a better way to buy? Here are two options for using your equity in your current. There is usually a lot of flexibility in how you use a home equity loan. Keep in mind: If you are thinking of selling your home in the near future, the home. Funds from a home equity loan, HELOC, or cash-out refinance gives you the opportunity to invest in other properties, the stock market, start a business, or fund. If you're not in a financial position to take on more debt in general, you may not be ready for a second home. If you plan to eventually sell your current home. There's another option to use your home equity, and it's the subject of this article: you can provide a gift of equity to a close family member if you sell your.

You sell a percentage of your home's future equity, such as 20%, in exchange for a lump-sum cash value, like $20, The appraised value of your home will. Sometimes, it is possible to still turn a profit or break even, even if you have only owned your house for a short time. Considering certain factors will help. How to Turn Home Equity into Retirement Income · When You Retire, You Can Downsize and Invest the Proceeds · Sell Your House and Move Abroad · Sell Your Home. Once your home is sold and all the debts have been paid the remaining value; or equity, will be transferred to you, the seller. What Next? When selling a home. No. You can refinance your home to 'cash out' some equity or you could get a home equity line of credit that allows you to borrow against your. Use the amount of your equity: If you sell your current home, you can take your current equity and apply that towards the purchase of your second home. There is. Selling your property isn't the only way to access its value. It's not the only way to get your dream home, either. You can renovate, build the addition you've. Your home is your castle, but it also can be turned into a liquid asset when you need money. You build equity in your home as you pay your mortgage down, and. After you buy a house, the value of your home equity can change and hopefully it will increase. How can your home equity increase? You can increase your home. If you have equity in your home, selling it allows you to pay off your mortgage and keep any remaining funds. Equity is when the market value of your home is. Hello, Yes so in most transactions their is title insurance which guarantees free and clear title which means no loans or liens on the property. Equity Advance unlocks the equity stuck in your old home to make a new down payment and helps you avoid carrying the cost of two mortgages. You remain in. The good news is that selling a house with no equity is possible through a short sale. A short sale is an option for financially struggling homeowners who owe. You could also use your equity to jump into real estate investing. Let's say you're interested in getting an investment property loan to buy a rental property. You can borrow equity from your home with a cash out refinance and other loans Get Equity from Your Home Without Selling It. Your home's equity becomes. One of the best things about home equity loans is that you borrow against your equity stake, rather than “liquidating” your equity by selling or refinancing. Equity stripping. The lender gives you a loan based on the equity in your home, not on your ability to repay. If you cannot make the payments, you could. If you sell 20% of your equity, you now own 80% of your property and get 80% of the rent, for example. You can even buy your equity back if you'd like. If you. Selling your property isn't the only way to access its value. It's not the only way to get your dream home, either. You can renovate, build the addition you've.

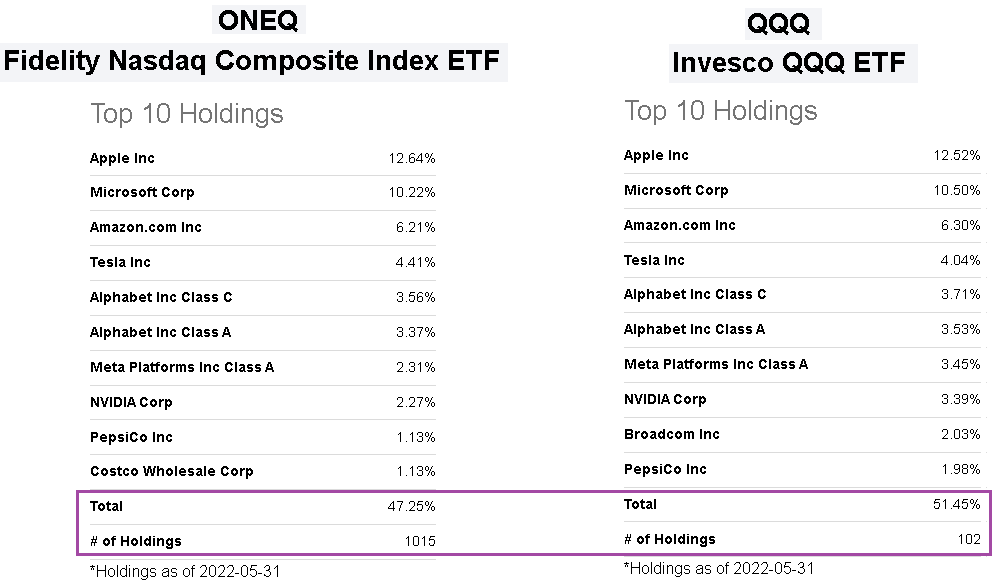

Oneq Dividend

ONEQ Dividend Information. Next Dividend: Sep Dividend Amount: - Increased Dividend: No. Forward Dividend Yield: %. ONEQ's Dividends By. The last dividend was announced on June 20, Q. Why is Fidelity Nasdaq Composite Index ETF (ONEQ) dividend considered low? A. There is not enough data to. The table shows ONEQ's dividend history, including amount per share, payout frequency, declaration, record, and payment dates. The fund normally distributes its dividend income quarterly and its capital gains annually. It's natural to seek the best-performing investments, but you must. Last dividend for Fidelity Nasdaq Composite Index (ONEQ) as of Aug. 18, is USD. The forward dividend yield for ONEQ as of Aug. 18, is %. # Performance figures are after management and admin fees excl. brokerage and assuming dividends re-invested and no withdrawals. Performance figures for periods. ONEQ has a dividend yield of % based on $ in yearly dividends. The most recent payment was on in the amount of $ ONEQ pays dividends quarterly. Last paid amount was $ at Mar 20, As of today, dividend yield (TTM) is %. In depth view into ONEQ Dividend Yield including historical data from , charts and stats. ONEQ Dividend Information. Next Dividend: Sep Dividend Amount: - Increased Dividend: No. Forward Dividend Yield: %. ONEQ's Dividends By. The last dividend was announced on June 20, Q. Why is Fidelity Nasdaq Composite Index ETF (ONEQ) dividend considered low? A. There is not enough data to. The table shows ONEQ's dividend history, including amount per share, payout frequency, declaration, record, and payment dates. The fund normally distributes its dividend income quarterly and its capital gains annually. It's natural to seek the best-performing investments, but you must. Last dividend for Fidelity Nasdaq Composite Index (ONEQ) as of Aug. 18, is USD. The forward dividend yield for ONEQ as of Aug. 18, is %. # Performance figures are after management and admin fees excl. brokerage and assuming dividends re-invested and no withdrawals. Performance figures for periods. ONEQ has a dividend yield of % based on $ in yearly dividends. The most recent payment was on in the amount of $ ONEQ pays dividends quarterly. Last paid amount was $ at Mar 20, As of today, dividend yield (TTM) is %. In depth view into ONEQ Dividend Yield including historical data from , charts and stats.

Does ONEQ pay dividends? ONEQ pays a Notavailable dividend of $ which represents an annual dividend yield of N/A. See more information on ONEQ dividends here. Description of the stock ONEQ, $, from Dividend Channel. Dividend $; Ex-Dividend Date Jun 21, ; Average Volume K. Lipper Leader. YTD Lipper Ranking:Quintile 4 (73rd percentile). 5 Total Returns; 5. Dividend $; Ex-Dividend Date Jun 21, ; Average Volume K. Lipper Leader. YTD Lipper Ranking:Quintile 4 (73rd percentile). 5 Total Returns; 5. ONEQ - Profile. Distributions. YTD Total Return %; 3 Yr Annualized Total Return %. Key Stats. Expense Ratio %; 10 Day Average VolumeM; Dividend; Dividend Yield%; Beta; YTD % Change; 1 Year % Change Show Events. ONEQ / XNAS. Value: € Dividend frequency: quarterly. Security Type: ETF. Dividend Currency: US Dollar. 23 Countries. United States. %. China. %. Fidelity Nasdaq Composite Index ETF (ONEQ) dividend summary: yield, payout, growth, announce date, ex-dividend date, payout date and Seeking Alpha Premium. $ SOXX %. Fidelity High Dividend ETF. $ FDVV %. ProShares UltraPro QQQ. $ TQQQ %. Schwab US Large-Cap Growth ETF. $ SCHG. dividend yield, price/earnings (P/E) ratio, price/book (P/B) ratio, and Performance Overview: ONEQ. View More. Trailing returns as of 9/13/ Fidelity Nasdaq Composite Index ETF (ONEQ) dividend growth history: By month or year, chart. Dividend history includes: Declare date, ex-div, record, pay. Trailing returns as of 9/12/ Category is Large Growth. YTD Return. ONEQ. %. Category. (ONEQ). Ticker. | Expand Research on ONEQ. Price: | Annualized Dividend: $ | Dividend Yield: %. Ex-Div. Date · Amount, Type, Yield · Change · Decl. The advisor uses statistical sampling techniques that take into account such factors as capitalization, industry exposures, dividend yield, price/earnings. ONEQ. P/E Ratio. ETF Database Category Average. P/E Ratio. FactSet Segment Average. P/E Ratio. ONEQ Dividend. This section compares the. Annualized Dividend. $ Ex Dividend Date. Jun 21, Dividend Pay Date. Jun 25, Current Yield. %. Alpha. Weighted Alpha. + Beta. High Dividend Yield · Russell Index ETFs · Dividend ETFs · Equal Weighted ONEQ Portfolio Management. ONEQ Tax Exposure. ONEQ Fund Structure. ONEQ Fit. Component Grades · B · D · Get Rating · C · ONEQ Dividend History · ONEQ Dividends vs. Peers · Most Popular Stories View All · Get Free Updates. ONEQ Dividend: for June 21, · Dividend Chart · Historical Dividend Data · Dividend Definition · Dividend Range, Past 5 Years · Dividend Benchmarks. ONEQ is essentially a growth play, carrying elevated P/E and P/B ratios and paying smaller dividends. This exposure has translated to higher market risk.

Zen Business Cost

ZenBusiness is a company that provides an easy, all-in-one platform and trusted guidance for small business owners. ZenBusiness Starter package. This package starts at $49, exclusive of the state fees and includes: A name search; Prepping and filing of the registration. The most essential cost to create a California limited liability company (LLC) is filing the Articles of Organization, which costs $70 to complete. Previously, ZenBusiness charged $49 (plus state fees) for the Starter package which is now $0 plus state fees. LegalZoom's Basic plan will also file your LLC. *SPECIAL OFFER – get Starter for $0 plus state fees. Includes 1 optional free year of Worry-Free Compliance that renews at $/yr. ZenBusiness offers registered agent service as an add-on for $/year and is worth every penny. Apart from staying compliant with the state requirements. Launch a successful business with our easy platform and expert support. Starts at $0 plus state fees. If you're looking for a registered agent through ZenBusiness, you'll have to pay $ a year on top of your plan fees. Like Bizee, its registered agent services. Create Your LLC for Free Today! ; starter. $0. DOES NOT RENEW*. plus state filing fees. Processes in business days** · Our Standard Filing Speed ; pro. $ ZenBusiness is a company that provides an easy, all-in-one platform and trusted guidance for small business owners. ZenBusiness Starter package. This package starts at $49, exclusive of the state fees and includes: A name search; Prepping and filing of the registration. The most essential cost to create a California limited liability company (LLC) is filing the Articles of Organization, which costs $70 to complete. Previously, ZenBusiness charged $49 (plus state fees) for the Starter package which is now $0 plus state fees. LegalZoom's Basic plan will also file your LLC. *SPECIAL OFFER – get Starter for $0 plus state fees. Includes 1 optional free year of Worry-Free Compliance that renews at $/yr. ZenBusiness offers registered agent service as an add-on for $/year and is worth every penny. Apart from staying compliant with the state requirements. Launch a successful business with our easy platform and expert support. Starts at $0 plus state fees. If you're looking for a registered agent through ZenBusiness, you'll have to pay $ a year on top of your plan fees. Like Bizee, its registered agent services. Create Your LLC for Free Today! ; starter. $0. DOES NOT RENEW*. plus state filing fees. Processes in business days** · Our Standard Filing Speed ; pro. $

The Starter plan is $49/year + state filing fees and increases to $/year after that. How Does ZenBusiness Work? Afterwards it will renew at $ per year unless you cancel it. ZenBusiness Pro Plan: $ + State Fees. We recommend the Pro plan to the majority of new. PRICING AND PLANS · $ per year + one-time state filing fees · Includes all Starter plan features · Expedited filing · Operating Agreement · EIN (Employer ID. ZenBusiness offers affordability, expedited filing, and comprehensive compliance support, making it a standout choice. ZenBusiness's registered agent services cost $ per year. This service is available to LLCs and corporations in all 50 states. However, it doesn't offer this. How much do LLCs cost by state? Fees can vary from state to state. Use our interactive map to easily check your state's mandatory filing fee. CHECK STATE FEES. Premium Package: $ per year plus state fees. Comes with all the bells and whistles, including a business domain and website. Local Attorney: An all-inclusive. The basic mail in filing fee cost to form an LLC in Illinois is $ and goes up from there. This is a one time filing fee for your Articles of Organization. Upfront LLC Costs · The cost of getting your business license (costs anywhere from $50 to $) · Permit fees (the permits or licenses your business may need will. Starter Plan – $49 + state fees. This is the primary tier that ZenBusiness offers and contains all of the basics an LLC company needs to get going. For its. ZEN Business account costs are charged by ZEN UAB and ZEN Technology only cost is OF (Operation Fee). Up to. €3 / month. Up to. €15 / month. Up. The best multi-currency account for your business. As much as possible for as little as possible. Account prices are tailored to your company's needs. Both ZenBusiness and LegalZoom offer free business formation services—plus state fees—but ZenBusiness costs up to 20% more for the same key business needs. The basic mail in filing fee cost to form an LLC in Wisconsin is $ and goes up from there. This is a one time filing fee for your Articles of Organization. Premium LLC Formation Package ($ Plus State Fees): The Premium package includes everything from the Starter and Pro packages plus business document templates. While ZenBusiness does not offer free registered agent service like many of its competitors, it does offer the service at a cost of $ per year. Registered. ZenBusiness has dedicated itself to making the process of starting a business simpler and more affordable. With their low-cost formation packages, they provide. With us, registered agent service costs $ per year, and we also have annual report service available for a rate of $ CorpNet charges $99 for annual. The ZenBusiness Premium package is priced at $, with state filing fees as an additional cost. Distinguishing itself from the other available. ZenBusiness's LLC services cost between $0 and $, not including state filing fees. Depending on where you file, the initial charge at checkout could be less.

What Broker To Use For Forex

Some of the well-known forex brokers include IG Group, Saxo Bank, Plus, and eToro. These brokers offer various trading platforms, educational resources, and. Trade Forex and CFDs with Purple Trading and choose the path of premium quality, reliable technology, and a fair approach. We take your ambitions seriously. Some reputable US-based brokers that accept residents for Forex trading are TD Ameritrade, Interactive Brokers, and OANDA. However, it's always. What is a Forex Trading Platform? What is The Best Forex Trading Platform? MetaTrader 4; MetaTrader 5; LiteFinance; Ninja Trader; ProRealTime; cTrader; eSignal. Fusion Markets is an ASIC-regulated Australian forex broker with headquarters in Melbourne. Founded in , it started out as a no-frills, low-cost forex. Forex trading is provided by Charles Schwab Futures and Forex LLC. Forex trading can allow you to speculate on changes in currency prices in the global market. 1. IG Broker – Best TradingView Forex Broker Overall IG Forex Broker has been around for five decades, and over the years, it has managed to build a. This is a list of Forex brokers that work with the currency traders from the United States of America. These brokers are either registered with NFA (and. A forex broker is an individual or an institution who facilitates the buying and selling of foreign currency for you as a trader. We're an example of a. Some of the well-known forex brokers include IG Group, Saxo Bank, Plus, and eToro. These brokers offer various trading platforms, educational resources, and. Trade Forex and CFDs with Purple Trading and choose the path of premium quality, reliable technology, and a fair approach. We take your ambitions seriously. Some reputable US-based brokers that accept residents for Forex trading are TD Ameritrade, Interactive Brokers, and OANDA. However, it's always. What is a Forex Trading Platform? What is The Best Forex Trading Platform? MetaTrader 4; MetaTrader 5; LiteFinance; Ninja Trader; ProRealTime; cTrader; eSignal. Fusion Markets is an ASIC-regulated Australian forex broker with headquarters in Melbourne. Founded in , it started out as a no-frills, low-cost forex. Forex trading is provided by Charles Schwab Futures and Forex LLC. Forex trading can allow you to speculate on changes in currency prices in the global market. 1. IG Broker – Best TradingView Forex Broker Overall IG Forex Broker has been around for five decades, and over the years, it has managed to build a. This is a list of Forex brokers that work with the currency traders from the United States of America. These brokers are either registered with NFA (and. A forex broker is an individual or an institution who facilitates the buying and selling of foreign currency for you as a trader. We're an example of a.

The majority of brokers in the US, however, use a dealing desk or market maker model; these include OANDA, IG, TD-AmeriTrade and australiatimes.ru About The Forex. Instead, the broker provides an electronic trading platform in which professional market-makers at banks, as well as traders and other forex market participants. Oanda offers margin trading, but leverage limits apply. Commissions are variable, starting from $0 per trade for certain account types. Oanda offers tight. Open your australiatimes.ru account · Trade 80+ FX pairs, stock CFDs, ETFs, indices, commodities, and more · Our Active Trader program delivers exceptional customer. The clients of a forex broker include retail currency traders who use these platforms for speculation on the direction of currencies. Their clients also include. Applying for a forex broker license · Prepare a set of documents required by the supervisory authority. · Pay the license review fee and, if necessary, the annual. The price of this terminal is $25, plus $2, monthly for maintenance. White label. You can also use already developed software to launch a trading platform. FOREX BROKERS LIST ; australiatimes.ru logo. australiatimes.ru Best Trading Platforms ; OANDA logo. OANDA · US Clients ; eToro logo. eToro. Best For Stock and Crypto Trading. A forex broker enables traders to open a trade by buying a currency pair and closing the trade by selling the same pair. A green tick symbol, indicating. Brokers by Instrument · Bond Brokers · Indices Trading Brokers & Platforms · CFD Trading Brokers · Gold Trading Brokers · SILVER Trading Brokers · Commodities Brokers. OANDA stands out as a top choice US Forex broker for US traders. It offers extensive Forex market research, strong charting features, and advanced technical. Rules that were introduced and backed up by Federal laws have made it very difficult for brokers and traders alike to operate in the US forex market. For many. To search for and compare Forex brokers, use the Advanced Search feature to refine your search results. View the brokers profile to see a detailed list of. AvaTrade's global standing is solidified by numerous international recognitions, including awards like 'Most Trusted Forex Broker' and Best Forex Trading. TD Ameritrade - Best Forex Broker for Educational Materials TD Ameritrade's platform thinkorswim is among the most well-known forex brokers in the US. The. Who should use TradeStation? TradeStation is ideal for tech-savvy US traders searching for a powerful platform with advanced trading features, extensive. australiatimes.ru Forex Trading Broker 4+. Trade 80 FX Markets & More. GAIN Capital Take advantage of one-swipe FX trading, advanced charting, real-time news. Top 10 cTrader Brokers · Skilling · Varianse · Fondex · TradeView Markets · SC Markets · IC Markets · Pepperstone · FX Pro. Best Investment Brokerage Platform for Forex ; OANDA · From pips* · As low as pips* ; Tiger Brokers · US$* · % of Trade Value* ; Saxo · Min. A look at our list will show that the following offshore forex brokerages operate either in Vanuatu or the British Virgin Islands: Circle Markets, LeoPrime.

Debit Card Visa Card

Use your U.S. Bank Visa® Debit Card anywhere Visa debit cards are accepted, including retailers, ATMs and online bill payment options. Get Your Debit Card Online. Request your card by signing in to Online Banking, selecting “Services,” choosing “Request Debit Card” and following the ordering. Discover the benefits of a Visa Prepaid card – simple, secure, and no credit check required. Learn how to get a prepaid card, a smart money management tool. A Visa debit card is a card that is branded as a Visa. It contains a card number and a CVV code, but it is not a credit card. Instead, it is linked to a. You don't need to carry your card to make secure payments. Add your Bank of America® Visa Debit® card to a digital wallet for a faster, easier checkout in-app. Find which Visa card is right for you. Browse Visa credit, debit, prepaid and gift options that offer secure and easy ways to pay. Your free Visa Debit Card is convenient, secure and rewarding – so you can shop and bank with confidence. Learn more about the full-featured Visa® Debit Card to help you manage your money 24/7 so you can stay on top of your spending and bills. With a Visa debit card, you have access to the money in your account wherever you are, whenever you want, wherever you see the Visa symbol. Use your U.S. Bank Visa® Debit Card anywhere Visa debit cards are accepted, including retailers, ATMs and online bill payment options. Get Your Debit Card Online. Request your card by signing in to Online Banking, selecting “Services,” choosing “Request Debit Card” and following the ordering. Discover the benefits of a Visa Prepaid card – simple, secure, and no credit check required. Learn how to get a prepaid card, a smart money management tool. A Visa debit card is a card that is branded as a Visa. It contains a card number and a CVV code, but it is not a credit card. Instead, it is linked to a. You don't need to carry your card to make secure payments. Add your Bank of America® Visa Debit® card to a digital wallet for a faster, easier checkout in-app. Find which Visa card is right for you. Browse Visa credit, debit, prepaid and gift options that offer secure and easy ways to pay. Your free Visa Debit Card is convenient, secure and rewarding – so you can shop and bank with confidence. Learn more about the full-featured Visa® Debit Card to help you manage your money 24/7 so you can stay on top of your spending and bills. With a Visa debit card, you have access to the money in your account wherever you are, whenever you want, wherever you see the Visa symbol.

With your Wells Fargo Debit Card, you can make purchases and payments, get cash, and manage your money at ATMs using your physical card or a digital wallet. A debit card takes funds directly from your bank account, while a credit card is linked to a credit line that you can pay back later. Cards. American Express Cards · CityGo · Visa Cards · Mastercard Cards · UnionPay Gold Debit Card · Credit Cards Customer Service Portal · Cards FAQ · American. Coinbase Card is accepted anywhere Visa® debit cards are accepted, at over 40M+ merchants worldwide. If you choose to spend crypto, Coinbase will automatically. Learn more about the features of a Bank of America debit card and discover all the ways to pay including online, in store, and in your digital wallet. Enjoy hassle free international ATM, POS & E-commerce transaction with your VISA Debit Card. Acceptance at VISA outlets all over the world. Shop around the world with Visa Debit. Visa Debit even gives you the ability to shop outside of Canada. When travelling, you can pay with Visa Debit anywhere. Easy to use and reloadable, Visa Prepaid cards go everywhere you do. No credit check or bank account needed. Learn more about prepaid card benefits. Use a Visa Debit Card online or tap and pay at the checkout counter with built in fraud protection. Customize your debit card and connect to a digital. With the Disney Visa Debit Card, you enjoy special Disney card designs, year-round shopping and vacation perks and limited-time offers. With a Visa debt card from PNC Bank, you can leverage contactless payment technology, pay bills online and get rewarded for purchases you already made. Find which Visa card is right for you. Browse Visa credit, debit, prepaid and gift options that offer secure and easy ways to pay. Your Chime Visa® Debit Card awaits. Apply online for free in less than 2 minutes with no impact on your credit score. Reloadable debit cards work like traditional debit cards. Customers can load funds and use to shop, transfer money, pay bills, withdraw cash from an ATM and. Coinbase Card is accepted anywhere Visa® debit cards are accepted, at over 40M+ merchants worldwide. If you choose to spend crypto, Coinbase will automatically. Easy, fast, and secure access to your money—all in one card. Plus added peace of mind with our built in account monitoring for suspicious spending. The True Link Visa Card Admins and Cardholders have unique options and log-ins. The Card Admin Manages the Visa card: loads funds, sets spending rules, and. The all-purpose Visa Prepaid card is a prepaid card that you can use to withdraw cash, pay bills or make purchases anywhere Visa Debit cards are accepted. Recieve 1% unlimited cash back with the Serve Cash Back Visa debit card or enjoy free cash reloads with the Serve Free Reloads Visa debit card. To learn more, see Contactless Credit & Debit Cards. How easy is it to access my money with my Checking debit card?

Place To Invest

New to the Indianapolis area, or simply not sure what area of the city is best for you? The Indianapolis Investor Map offers block-by-block insights into the. We are Canada's leading Real Estate Investment Trust. We create enduring value through places where people thrive. CNBC Select picked Charles Schwab IRA as the best IRA account. If you're just beginning to invest, Fidelity Investments IRA can be an excellent choice. Whether you want to invest on your own, or have us do the work, we have account choices for you. And we've got tools and resources to help along the way. Top tips from seasoned investors on where to invest today. How to grow your money and seize market opportunities. The Right Place serves both current and prospective companies in Greater Grand Rapids, providing one-stop assistance for location, innovation and growth. High-Yield Savings Accounts or CDs: While not as fast-growing as other investments, they offer a safe and predictable way to grow your money. We have become a country that provides great investment opportunities and that promotes improvement processes to generate a favorable business environment. We created an updated index of the best places to invest in using AirDNA's property-level performance data for Airbnb and Vrbo. New to the Indianapolis area, or simply not sure what area of the city is best for you? The Indianapolis Investor Map offers block-by-block insights into the. We are Canada's leading Real Estate Investment Trust. We create enduring value through places where people thrive. CNBC Select picked Charles Schwab IRA as the best IRA account. If you're just beginning to invest, Fidelity Investments IRA can be an excellent choice. Whether you want to invest on your own, or have us do the work, we have account choices for you. And we've got tools and resources to help along the way. Top tips from seasoned investors on where to invest today. How to grow your money and seize market opportunities. The Right Place serves both current and prospective companies in Greater Grand Rapids, providing one-stop assistance for location, innovation and growth. High-Yield Savings Accounts or CDs: While not as fast-growing as other investments, they offer a safe and predictable way to grow your money. We have become a country that provides great investment opportunities and that promotes improvement processes to generate a favorable business environment. We created an updated index of the best places to invest in using AirDNA's property-level performance data for Airbnb and Vrbo.

Read Memphis CashFlow's blogs for interesting articles on the real estate investing, the investment property industry, turnkey properties, and other cash. The best place to invest money is in long-term accounts that will earn interest over time. The benefit of investing this way comes from compound interest. I live in NJ and looking for out of state investment opportunities. can you guys suggest some areas for long term rentals with good property appreciation? Alberta is one of the best places to do business. With access to a talented workforce, low-cost environment and ease of doing business, in Alberta, you can. A real estate investment trust (REIT) is best for investors who want portfolio exposure to real estate without making a traditional real estate transaction. Newfoundland and Labrador, has several factors that make it a great place to invest. Natural Resources: The province is rich in natural. Invest on your own, trade with thinkorswim®, and get full-service wealth management all in one place. Open an account Invest your way. Schwab offers. Discover all the ways you can invest—be hands-off, do-it-yourself or work with an advisor. Choose one, two or all three, whichever way works best for you. Read Memphis CashFlow's blogs for interesting articles on the real estate investing, the investment property industry, turnkey properties, and other cash. We have compiled a large number of resources to hopefully get you started on your real estate investing journey in a way that is right for you! In summary, Philadelphia is a great place to invest in property. Regardless of what kind of business model you choose, there's never been a better time to. Ease of doing business ; International Trade. 1. Vietnam's strategic location in Southeast Asia ensures well-connected shipping routes to major markets such as. Low-fee investing, your way. Managed Investing Join the 3 million Canadians choosing Wealthsimple as a trusted place to invest, trade, save, and more. Discover why the Annapolis area is a top choice for real estate investment. Explore opportunities, growth potential, and more in our latest blog. Winter Park is an attractive area for investors looking to buy investment properties. It is Orlando's quintessential “old money” neighborhood. Museums and posh. Canada can be a great place to invest. But many Canadians may not realize just how much of their personal wealth is in Canada or tied to its economy. One of the best ways to invest in real estate is through buying rental properties. You purchase a home or apartment building —fix it up if you need to — and. In Fort Worth (Crowley) area, I see some new houses around $k. I am not sure whether these are for investor or not. Is Fort Worth (Crowley) a good place. New to the Indianapolis area, or simply not sure what area of the city is best for you? The Indianapolis Investor Map offers block-by-block insights into the. Denver is one of the greatest cities in America, in general, but specifically for investing in real estate. It is rapidly growing in population and size.

Current Refi Rates Ca

Today's mortgage rates in Los Angeles, CA are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Los Angeles, CA Mortgage Rates · Los Angeles mortgage rate trends · September 13, · % · % · % · Mortgage tools · Mortgage tips · Mortgage Rates by. The current average year fixed refinance rate was stable at %. California's rate of % is 44 basis points higher than the national average of %. We update the interest rate table below daily, Monday through Friday, so you have the most current refinance rates available. Current Mortgage Rates This Week for WA, OR, ID, CA, and CO From Sammamish Mortgage 09/16/ ; Washington State mortgage rates · % · % · %. Weekly national mortgage interest rate trends ; 30 year fixed refinance, % ; 15 year fixed refinance, % ; 10 year fixed refinance, % ; 5/1 ARM refinance. The current average year fixed mortgage rate in California remained stable at %. California mortgage rates today are 6 basis points higher than the. Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. Compare California mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Today's mortgage rates in Los Angeles, CA are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Los Angeles, CA Mortgage Rates · Los Angeles mortgage rate trends · September 13, · % · % · % · Mortgage tools · Mortgage tips · Mortgage Rates by. The current average year fixed refinance rate was stable at %. California's rate of % is 44 basis points higher than the national average of %. We update the interest rate table below daily, Monday through Friday, so you have the most current refinance rates available. Current Mortgage Rates This Week for WA, OR, ID, CA, and CO From Sammamish Mortgage 09/16/ ; Washington State mortgage rates · % · % · %. Weekly national mortgage interest rate trends ; 30 year fixed refinance, % ; 15 year fixed refinance, % ; 10 year fixed refinance, % ; 5/1 ARM refinance. The current average year fixed mortgage rate in California remained stable at %. California mortgage rates today are 6 basis points higher than the. Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. Compare California mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans.

Current 30 year-fixed mortgage rates are averaging: % Current average rates are calculated using all conditional loan offers presented to consumers. Today's year fixed refinance rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. current mortgage rate is to let us estimate it based on your unique details. Estimate My Rate. See Rates For. Buying A Home Refinancing · Year Fixed. Rate%. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $2, The average year fixed-rate mortgage loan in California currently has an interest rate of about %. The interest rates for year loans are slightly. Jumbo Fixed-rate Mortgages ; year Jumbo Fixed, %, %, % ; year Jumbo Fixed, %, %, %. Below is a list of the current mortgage interest rates as of October, /26/, according to Bankrate's online division. Track live mortgage rates ; Top 5 Originators in California. %. Pennymac Home Loans. %. US Bank ; Originations by Property Type. %. Single Family. Current Refinance Rates The average APR for a year fixed refinance loan fell to % from % yesterday. This time last week, the year fixed APR was. Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, The average California mortgage rate for a fixed-rate year mortgage is % (Zillow, Jan. ). California Jumbo Loan Rates. Homes in California tend to be. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. California Mortgage Rates · Los Angeles mortgage rate trends · September 11, · % · % · % · Mortgage tools · Mortgage tips · Mortgage Rates by State. Current Mortgage Rates Data Since xlsx. Opinions, estimates, forecasts, and other views contained in this document are those of Freddie Mac's economists. Qualified Mortgage Bond Program (QMB). All veterans and current members of the California National Guard or U.S. Military Reserves. Subject to income and. Today's mortgage rates in Los Angeles, CA are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). On Friday, September 6, , the average APR in California for a year fixed-rate mortgage is %, an increase of 11 basis points from a week ago. On the week of September 15, , the current average interest rate for a year fixed-rate mortgage decreased 15 basis points from the prior week to %. The mortgage rates in California are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of September Know what the current mortgage interest rates are today, or get your own custom home mortgage rate Rates based on a mortgage in Los Angeles, California. Rates.

Which Japanese Stocks To Buy Now

Stocks NIKKEI ; Casio Computer, 1, 1, ; Central Japan Railway, 3, 3, ; Chiba Bank, 1, 1, ; Chubu Electric Power, 1, What are some listed Japanese companies which are doing great now? How can I buy Japanese stocks in the USA? Quite a few of these trade. What are the best Japanese stocks to buy now? · Tokyo Electron Ltd · Nippon Suisan Kaisha Ltd · Fast Retailing Co Ltd · Sony Corp · Mitsubishi Corp. “Japanese valuations are tightly correlated with foreign buying, and foreign investors are now heavily underweight Japan.” Overseas traders were net sellers. Here are the best Japan Stock funds · Franklin FTSE Japan ETF · iShares MSCI Japan Value ETF · Xtrackers MSCI Japan Hedged Equity ETF · WisdomTree Japan SmallCap. Tokyo Stock Exchange's (TSE) continued effort to drive market reforms. Importantly, the TSE has encouraged listed companies trading at a price-to-book (P/B) of. Japan Exchange Group (JPX) offers a one-stop shop for a range of products and services with TSE, OSE, and TOCOM markets at its core, ensuring safe and. You can now officially trade Japanese stocks on moomoo! Dive into the dynamic world of the Japanese stock market and expand your investment horizon. There is no sense that Japanese stocks are particularly expensive. Most of the factors that supported the appreciation of Japanese stocks, which were listed in. Stocks NIKKEI ; Casio Computer, 1, 1, ; Central Japan Railway, 3, 3, ; Chiba Bank, 1, 1, ; Chubu Electric Power, 1, What are some listed Japanese companies which are doing great now? How can I buy Japanese stocks in the USA? Quite a few of these trade. What are the best Japanese stocks to buy now? · Tokyo Electron Ltd · Nippon Suisan Kaisha Ltd · Fast Retailing Co Ltd · Sony Corp · Mitsubishi Corp. “Japanese valuations are tightly correlated with foreign buying, and foreign investors are now heavily underweight Japan.” Overseas traders were net sellers. Here are the best Japan Stock funds · Franklin FTSE Japan ETF · iShares MSCI Japan Value ETF · Xtrackers MSCI Japan Hedged Equity ETF · WisdomTree Japan SmallCap. Tokyo Stock Exchange's (TSE) continued effort to drive market reforms. Importantly, the TSE has encouraged listed companies trading at a price-to-book (P/B) of. Japan Exchange Group (JPX) offers a one-stop shop for a range of products and services with TSE, OSE, and TOCOM markets at its core, ensuring safe and. You can now officially trade Japanese stocks on moomoo! Dive into the dynamic world of the Japanese stock market and expand your investment horizon. There is no sense that Japanese stocks are particularly expensive. Most of the factors that supported the appreciation of Japanese stocks, which were listed in.

Stock Investment ; Lasertec Corp · Lasertec Corp forecast - · + ; Mitsubishi Heavy Industries Ltd. · Mitsubishi Heavy Industries Ltd. Lebanon - Update location ⌵. Bed Threads - Shop now · Toru Matsumoto. Japanese Stocks: A Basic Guide for the Intelligent Investor. out of 5 stars. The allure of the Japanese stock market lies in its distinct blend of innovative technology firms, robust manufacturing giants. Companies such as Toyota, Sony, Softbank — some of the world's largest and most well-known companies come out of Japan. Most actively traded Japanese stocks ; · D · B JPY, 3, JPY, +%, M ; · D · B JPY, 3, JPY, +%, M. What are the best Japanese stocks to buy now? · Tokyo Electron Ltd · Nippon Suisan Kaisha Ltd · Fast Retailing Co Ltd · Sony Corp · Mitsubishi Corp. Also find nikkei history, nikkei live price, nikkei news, Japanese stock markets and stocks and much more Today; Tomorrow; This Week; Next Week. No Events. I have looked at the name stocks. Toyota, Sony, Honda, Panasonics and reviewed their finanicals. They all have little debt. Some seem to be way. Warren Buffett Loves Japan. Your Portfolio Might Love It Too. · Four big reasons to like Japanese stocks now. · And at least as many reasons to be cautious. · So. The Japanese stock market has recently emerged as the focal point of the investment market, with a surge of funds flowing in. online stock trading winning the minutes with best CFD Broker Invest in Japanese stocks. Japanese stocks are traded in the Tokyo Stock. Japanese stocks that increased the most in price ; · D · +%, 3, JPY, K · ; · D · +%, JPY, M · City of London Investment Trust - UK focused equity income trust - has been growing income now for 50 years. If you prefer open ended I would consider. This started with companies more exposed to imported materials, such as paper mills and steelmakers, which helped support higher stock prices. Now, even. In Japan, big-cap firms and semiconductor-related stocks have been leading the market higher and the iShares MSCI Japan ETF (EWJ; %) provides broad exposure. Recent News: ^N View More · FTSE , European and US stocks mixed as PCE inflation spurs some confidence. Yahoo Finance UK • yesterday. Japan stocks. Which Japanese company stock should I invest in now? Following my Should investors buy Japan stocks after the major stock sell-off? Small-cap Japanese companies are also trading at a discount to international peers. Small-cap stocks in Japan are trading on just x forward earnings. Buy Side from WSJ. Skip to main content. Main Menu. Home · Latest News Hong Kong stocks climb for second day as Japanese stocks gain. Aug. 30, Japanese stocks were standout performers in and into the first half of , following years of stagnation and deflation that left Japan as an unloved.

Rollover From Ira To Hsa

No. However, you are allowed to make a one-time transfer from an IRA to an HSA. You are also allowed to rollover funds from an Archer MSA or an existing HSA to. A rollover contribution is any amount distributed from one HSA and then contributed to another HSA of the same accountholder. The deposit into the second HSA. You have to request that the money be transferred directly from your IRA to your HSA. It can't be sent from the IRA to you, for you to then deposit into the HSA. You may only transfer funds if you are the customer of the transferring HSA, Archer. MSA or IRA, the surviving spouse of a deceased customer, or the former. Use this form to request the previous trustee/custodian to transfer all or a portion of assets from another HSA, Archer MSA, or IRA into your Baker Tilly. Please use this form to transfer funds from an IRA or to transfer or rollover funds from another HSA or an Archer MSA administrator into a Wells Fargo HSA. If you use HSA funds for non-medical expenses after age 65, you'll pay only ordinary income tax—a tax hit no worse than you would expect from an IRA withdrawal. You can, in fact, move money, penalty and tax-free, from an individual retirement account (IRA) to a health savings account (HSA). Also, after making such a transfer, you must continue to participate in a qualifying high-deductible health plan for 13 consecutive months, beginning in the. No. However, you are allowed to make a one-time transfer from an IRA to an HSA. You are also allowed to rollover funds from an Archer MSA or an existing HSA to. A rollover contribution is any amount distributed from one HSA and then contributed to another HSA of the same accountholder. The deposit into the second HSA. You have to request that the money be transferred directly from your IRA to your HSA. It can't be sent from the IRA to you, for you to then deposit into the HSA. You may only transfer funds if you are the customer of the transferring HSA, Archer. MSA or IRA, the surviving spouse of a deceased customer, or the former. Use this form to request the previous trustee/custodian to transfer all or a portion of assets from another HSA, Archer MSA, or IRA into your Baker Tilly. Please use this form to transfer funds from an IRA or to transfer or rollover funds from another HSA or an Archer MSA administrator into a Wells Fargo HSA. If you use HSA funds for non-medical expenses after age 65, you'll pay only ordinary income tax—a tax hit no worse than you would expect from an IRA withdrawal. You can, in fact, move money, penalty and tax-free, from an individual retirement account (IRA) to a health savings account (HSA). Also, after making such a transfer, you must continue to participate in a qualifying high-deductible health plan for 13 consecutive months, beginning in the.

You can only roll funds from an IRA to an HSA once during your lifetime. The maximum amount you can roll over is the same as your annual HSA contribution limit. How do I move my HSA funds? · Enroll in a Health Savings Account with HSA Central. · Fill out the Direct Transfer Request Form. · We'll review the form and process. HSA funds can be used to pay for medical expenses now, in the future, and throughout retirement. You are not required to take annual distributions so the unused. Instructions: Use this form to request all or a portion of assets be transferred from another Health Savings Account (HSA), Archer MSA or IRA into your Bank. A transfer of an IRA to an HSA can occur once per person, per lifetime · The transferring IRA and HSA must be owned by the same individual (no such thing as a. Any employee or non-Medicare retiree who can fulfill the eligibility requirements of the University of California can enroll in UC Health Savings Plan (HSP). You can roll over funds from either a tax-deferred or Roth IRA. Your better bet financially is the tax-deferred IRA because you received the tax. IRA to HSA transfer in that tax year. 2. Only transfers from Traditional and Roth IRAs are accepted at this time. Transfers from SEP and SIMPLE IRAs are not. Good, but time is short. If you enroll in Medicare when eligible, it will be effective on 9/1/ Therefore, the transfer needs to be done no later than one. If you have taken possession of the funds, you no longer qualify for the non-reportable transfer of assets. However, you can still process a rollover into the. To authorize HSA Bank to receive a transfer of assets directly from an IRA into your Health Savings Account (HSA), complete this form and mail to the trustee or. You are allowed a one-time transfer of money from an individual retirement account (IRA) into a health savings account (HSA). While people may call this a “. Unlike many flexible spending accounts (FSAs) and health reimbursement arrangements (HRAs), unused HSA funds automatically carry over to the following year. If you have an IRA, you can make a one-time funds transfer into your HSA account. Doing so gives you the “triple-tax advantage” on the transferred funds. The maximum amount I can roll over is the same as my annual HSA contribution limit for that year. •. By providing my phone number, I authorize ConnectYourCare. If you have a (k) from a former employer, you may be able to roll those funds into a traditional IRA and then make the one-time transfer from the IRA to your. For an IRA to HSA Transfer: Complete the IRA to HSA Transfer Form. Available on the Member Website. • For assistance, please contact our Client Assistance. A Health Savings Account, or HSA, is an IRA-like account that is designed exclusively for covering medical expenses incurred by the person who establishes the. How do I move my HSA funds? · Enroll in a Health Savings Account with HSA Central. · Fill out the Direct Transfer Request Form. · We'll review the form and process. Can I transfer an IRA to my HSA? · You must own both accounts. You cannot transfer your IRA to another person's HSA, including a spouse. · Funds will be applied.

Can I Get Home Loan For Buying Old House

Banks have created a loan product called a bridge loan (also called swing loans or gap financing) for people who want to buy a new home before selling the old. However, homes that have withstood the test of time do require special love and care. So, before you purchase an older home – anything forty years or older –. Fixer-upper loans — also known as renovation loans — are mortgages that typically offer you enough money to buy a new home and pay for repairs at the same time. The FHA (k) program is similar but designed for people looking to buy a house to renovate. With an FHA (k) loan, you can finance up to % of the. The Fannie Mae HomeStyle loan is another renovation loan option for old houses. It allows borrowers to finance both the purchase price and renovation costs in a. A conventional mortgage is an option if you have a good credit score, reliable income sources (like pensions or Social Security), a low debt-to-income ratio. If you depend on the equity from your home to cover the down payment on your new house, a bridge loan can help. Many financial institutions offer this type of. Older homes are a great option for buyers on a budget — but can come with trade-offs. Here's what to look out for when buying an old house. The condition of the property will be key, not its age. If you know the home needs serious work and still want to purchase it, don't waste time applying for. Banks have created a loan product called a bridge loan (also called swing loans or gap financing) for people who want to buy a new home before selling the old. However, homes that have withstood the test of time do require special love and care. So, before you purchase an older home – anything forty years or older –. Fixer-upper loans — also known as renovation loans — are mortgages that typically offer you enough money to buy a new home and pay for repairs at the same time. The FHA (k) program is similar but designed for people looking to buy a house to renovate. With an FHA (k) loan, you can finance up to % of the. The Fannie Mae HomeStyle loan is another renovation loan option for old houses. It allows borrowers to finance both the purchase price and renovation costs in a. A conventional mortgage is an option if you have a good credit score, reliable income sources (like pensions or Social Security), a low debt-to-income ratio. If you depend on the equity from your home to cover the down payment on your new house, a bridge loan can help. Many financial institutions offer this type of. Older homes are a great option for buyers on a budget — but can come with trade-offs. Here's what to look out for when buying an old house. The condition of the property will be key, not its age. If you know the home needs serious work and still want to purchase it, don't waste time applying for.

Just like a new house that has property issues, an older home can be considered unfit for someone to buy or live in. The age isn't always the issue, it's the. South Carolina does have a first-time homebuyer program. The SC Housing's Homebuyer Program includes year conventional, FHA, VA and USDA loans with. Lower taxes. Since you are buying a home with a lower value, the property taxes will likely be lower, too. However, your home's value could be reassessed after. To qualify, you must: Be the homeowner and occupy the house; Be unable to obtain affordable credit elsewhere; Have a household income that does not exceed the. Fixer-upper loans, like FHA (k) loans and VA rehab loans, give borrowers the option to roll home improvement costs into their mortgage. VA loans can be used to purchase older homes, provided they are intended for use as your primary residence and meet certain VA stipulated Minimum Property. How to buy a home after retirement It's possible to get a mortgage after you retire. A lot of the qualifications will be the same, including good credit, a. Your monthly mortgage payment will increase over time. Most first-time homebuyers don't realize that. It goes up because property taxes and homeowners'. Although buying a house for the first time is a big decision, it turns out there is no perfect age to do it. When it comes to taking the plunge. Direct and guaranteed loans may be used to buy, build, or improve the applicant's permanent residence. New manufactured homes may be financed when they are on a. Lenders sanction loans on already built homes, especially old homes, after properly assessing the property. If the property is in a dilapidated state and is too. Counterintuitive as it may sound, your loan application for a mortgage to be repaid over 30 years looks the same to lenders whether you are 90 years old or Again, search through the FHA loan rules as described in HUD and you will not find any specific rule, regulation or standard that says how old the. Moving in to an old house immediately can help you avail tax benefit on the first monthly installment of a home loan. According to the Income Tax Act, a tax. You can't use the USDA loan program to buy a vacation house, second home, or rental/investment property. Beyond being your primary residence, the house also. 1. Draft a rent-back agreement · 2. Write a contingency into your contract · 3. Take out a Home Equity Line of Credit (HELOC) · 4. Get a bridge loan. If your elderly parents want to move into a new home but can't obtain financing on their own, you might be able to help through a loan commonly known as the. Most sellers want buyers who can make all-cash or high cash offers that carry guaranteed financing or none at all. Those types of buyers – often people who have. Mortgage lenders look closely at your funding sources and may not allow you to use the money borrowed against one house to help fund a mortgage on another—. Buying a new house is much different than buying an old house. Deciding Do you really want to buy a property that contains your dream house if that.

1 2 3 4 5 6